Current Ratio Less Than 1

Given the structure of the ratio with assets on top and liabilities on the bottom ratios above 10 are sought after. A ratio greater than 1 eg 20 would.

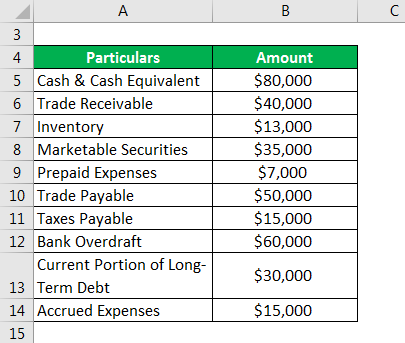

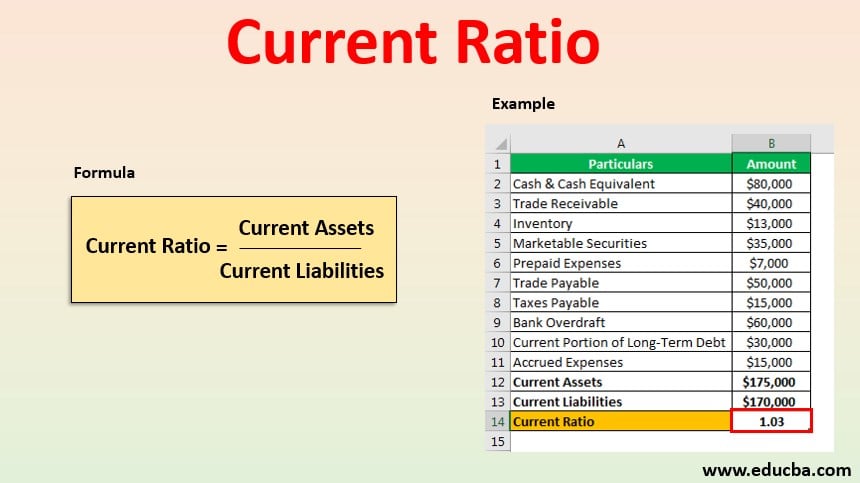

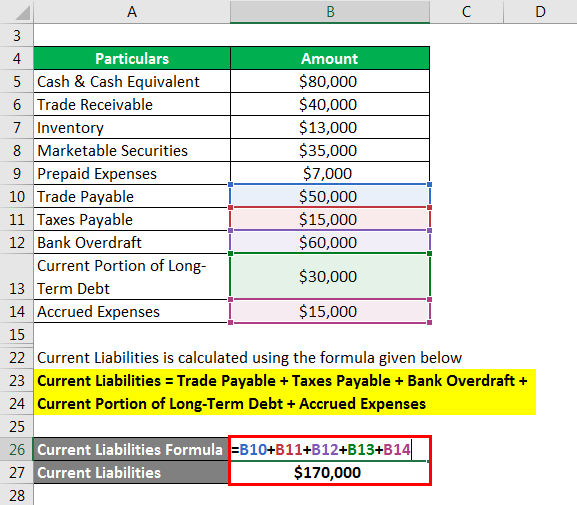

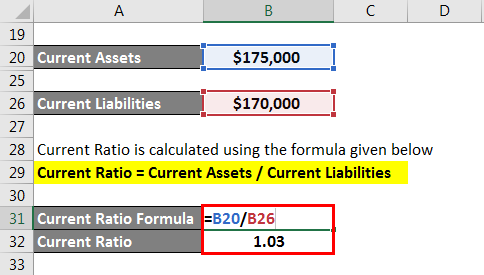

Current Ratio Examples Of Current Ratio With Excel Template

This is especially true of the retail sector which is dominated by giants such as Wal-Mart and Tesco.

. All other things. Correct option is C Current ratio is the measure of liquidity of a company at the certain date. A ratio higher than 3 could show an inefficient use of working.

When a firm has the ability to pay back in the short term. The compression ratio is the ratio between two elements. A ratio of 1 means that a company can exactly pay off all its current liabilities with its current assets.

Conversely a current ratio lower than 1 means the business debts exceed its assets which can be a red flag for financial danger and signifies that you need to improve liquidity. If a company has a current ratio of less than one then it has fewer current assets than current liabilities. Hence with low current assets and higher current liabilities.

Current Ratio 1 This happens when a companys assets and liabilities are equal. If inventory turns into cash much more rapidly than the accounts payable become due then the firms current ratio can comfortably remain less than one. Supermarkets for instance tend to operate at current ratios below 1 because they have few trade receivables have a high level of trade payables and have tight cash control.

A ratio of 11 indicates that current assets are equal to current liabilities and that the business is just able to cover all of. When current ratio is low and Current liabilities exceeds current assets the company may have problems in meeting its short term obligations. It might be very common in certain industries to have current ratios lower than 1.

Current Ratio 1 is a potential red flag for investors. In airline business equity to assets ratio is also very low as airlines leverage assets upto 80 to 90 of their total assets because of very high cost of capital. When the current ratio is greater than 1 it means the current liabilities of the company are greater than its current assets whereas when the current ratio is less than 1 it means that the current assets of the company are greater than its current liabilities.

Hence most of the airlines would have equity to assets ratio in the range of 01 to 02. Current ratio Current Assets Current Liabilities The current ratio is an indication of a firms liquidityAcceptable current ratios vary from industry to industry. Typically we take a period of less than a year.

Current ratio ought to be less than 1. A high current ratio can be signs of problems in managing working capital. By contrast a current ratio of less than 1 may indicate that your business has liquidity problems and may not be financially stable.

A ratio greater than 1 represents the favorable financial position of having more assets than debts. They carry high credit risk. However in most cases a current ratio between 15 and 3 is considered acceptable.

Another company that may surprise you to have a small current ratio is Wal-Mart 1. This means that the assets and the liabilities are supposed to be met in the short run. A ratio of less than 1 eg 075 would imply that a company is not able to satisfy its current liabilities.

Some investors or creditors may look for a slightly higher figure. Some types of businesses can operate with a current ratio of less than one however. A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations.

A current ratio below 1 means that the company doesnt have enough liquid assets to cover its short-term liabilities. A ratio of less than 1 eg 075 would imply that a company is not able to satisfy its current liabilities. This primarily stems from the fact that such retailers are able to negotiate long credit periods with suppliers while offering little credit to customers leading to higher trade payables as compared.

This happens if a companys current assets are less than its current liabilities. This happens if a companys current assets are less than its current liabilities. It is important to note that both of these are current.

Such companies may have to raise additional funds or sell long-term assets to pay their loans. A ratio higher than 3 could show an inefficient use of working capital. The higher ratio the higher is the safety margin that the.

In some industries current ratio of lower than 1 might also be considered acceptable. A current ratio less than one is an indicator that the company may not be able to service its short-term debt. The current ratio is calculated by dividing the current assets by the current liability.

Current ratio ought to be less than 1.

Current Ratio Examples Of Current Ratio With Excel Template

Current Ratio Examples Of Current Ratio With Excel Template

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

No comments for "Current Ratio Less Than 1"

Post a Comment